The telecom equipment market looks like hell after the fire went out. The Small Form Factor (SFF) market is hopelessly fragmented and looks like an Arkansas trailer park after a tornado. The medical board markets moved to China. And the military board and systems market is awaiting the outcome of sequestration and the new DOD budget negotiations in congress. Maybe it’s time to look at our business models in this industry and make some changes.

Back to basics

There are only three values to add to the basic electronic components, build boards and systems with them, and make money:

Manufacturing Value: Designing board and systems products with a “reference design⢠from a CPU vendor only adds manufacturing value. In high volume, manufacturing value will get about 8 percent Gross Profit Margin (GPM). If you doubt that statement, go look at the financials of the Contract Electronics Manufacturers (CEMs). Because of the typical low volumes in our industry (compared to CEMs), that translates into maybe 10-15 percent GPM at best. But, over time, as your volumes go up on SFF or telecom boards, you will approach 8 percent GPM. Manufacturing-value-added products have very little differentiation, which leads to low margins and financial leprosy.

Service Value: In this industry, service-value-added is integration: putting together boards, boxes, power supplies, cables, and some software. Service-value-added will get about 20-25 percent GPM in our industry. The inherent problem with service-value-added is that it requires expensive engineering talent to put things together and make them work. That limits the volumes an integrator can produce since integration is labor-intensive. Plus, those integration engineers must multi-task across several complex integration projects at one time. Companies who concentrate on service-value-added products are also vulnerable to systems vendors, who design and build complete systems and subsystems for certain applications.

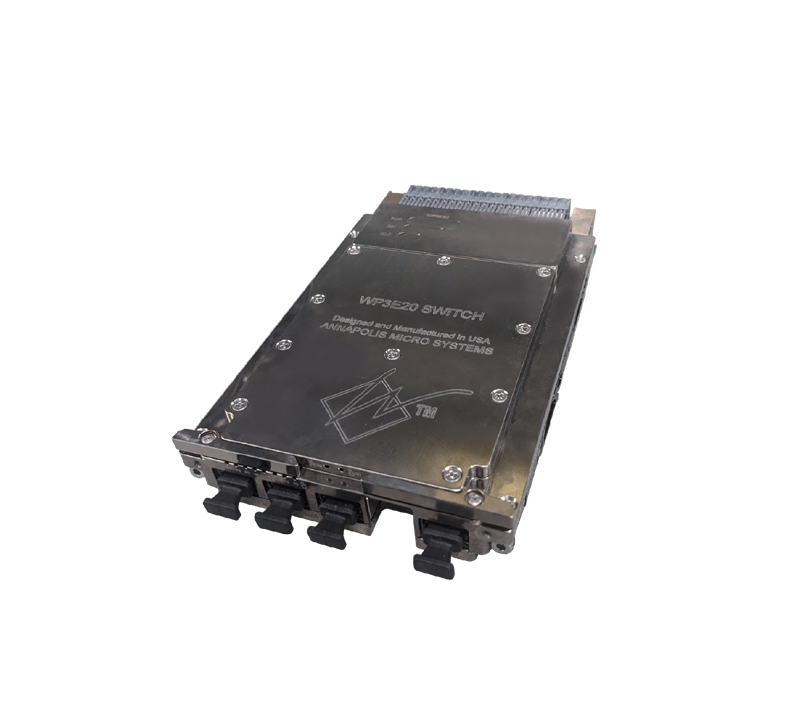

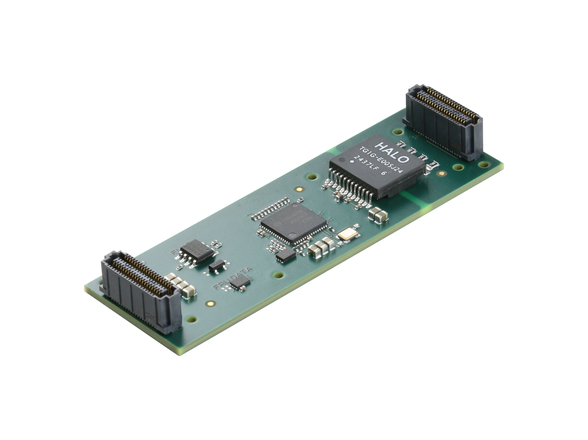

Intellectual Value: The first characteristic of intellectual-value-added vendors is that they design and build complete systems and subsystems. They do things that neither board vendors nor integrators can do: they add innovation, quality, reliability, and application-specific knowledge to electronic components. Intellectual-value-added will get about 50-70 percent GPM in most instances. The industry press talks about the shift away from boards and toward systems and subsystems, but they don’t talk about the reasons. System vendors are taking over the integration business, and parts of the board business, at higher margins with very specific application-targeted products.

Things are perfectly clear

Many companies adopted a technology-based diversification strategy years ago, offering the same manufacturing-value-added low-margin commodity board products across a large spectrum of applications, seeking volume and growth. That drove their margins down (toward 8 percent GPM) as they gained market share. A company’s GPM is a measure of the quality of its revenues. The market share leader in a low margin manufacturing-value-added segment is just the leper with the most fingers.

Others adopted an integration strategy: use the products the company already has, along with products from others, and integrate them into systems and subsystems for specific applications. That worked for a while, but the volumes and growth potential are inherently low. And at this stage, the integrators are competitively vulnerable to the companies who design and build complete systems and subsystems.

Still others adopted a target-market strategy and designed complete systems and subsystems for specific market segments and applications. RADAR, SONAR, SIGINT, Electronic Warfare, and COMINT systems are perfect examples in the military markets. The only strategy to consider today, as our markets continue to evolve, is a GPM strategy based on designing and building systems and subsystems, and adding intellectual value. If a company stays with manufacturing-value-added products, margins will kill it. If a company stays with service-value-added integrated products, the systems builders will kill it.

Now that you know what to do, go out there and do it!