Continuing its aggressive purchasing strategy, GE Fanuc Embedded Systems announced today that the acquisition of Radstone Technology is now complete. For a price of 130.4 million pounds (about $254.5 million), industry trail blazer Radstone joins the growing stable of GE’s embedded companies, which now include (in the order I can best remember): VMIC, Ramix, Condor Engineering, SBS, and maybe a couple of others I’ve forgotten.

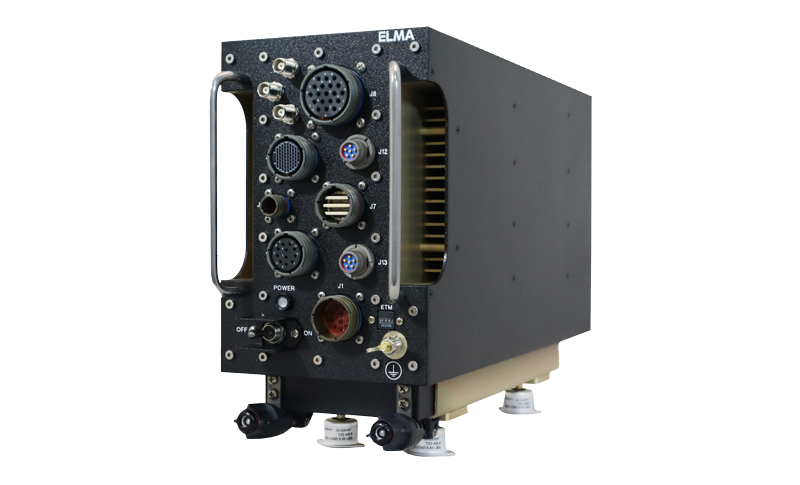

I once called Radstone one of the “Big Three” which in the late 90s included Dy 4 Systems, Radstone, and VISTA Controls. Of course, both Dy 4 and VISTA are now part of Curtiss Wright Controls Embedded Computing (CWCEC) but how they got there is a long story. Radstone has a multi-decade proud history as a COTS innovator, well before the term “COTS” was in general use. Back then, the term was “NDI” (if you know what that stands for, you’ve probably been in the industry a while) and Radstone played a key role not only in the adoption of VME, but in the development of the IEEE 1101.2 conduction cooling spec for Eurocards. Today, Radstone is a leader not only in rugged military modules, but in the increasingly important business of military obsolescence management.

Key questions: what’s this mean to Radstone’s customers? To Radstone’s competitors? To the industry in general? The internal-to-GE organization hasn’t been disclosed, but let me make a few predictions. Radstone’s executive management in the UK (under Peter Cavill) is top-notch, and there’s no reason that any of them will change. GE Fanuc Embedded’s president and CEO Maryrose Sylvester needs stability in Radstone, and the long tenures of Radstone’s Exec is the epitome of rock-solid. I expect that Radstone’s management will eventually be put in charge of GE Embedded’s European and ROW (rest of world) operations, leaving the SBS/VMIC/Condor management to deal with the Americas.

Moreover, looking at Radstone and SBS, and to a certain extent VMIC (who hadn’t previously been visibly focused on extended temp/conduction cooled LRUs), there will be a sorting out of which engineering team holds what core competencies. Radstone clearly has the stripes for conduction cooled and obsolescence management with strong MOD/DoD contractual program management T’s and C’s, while SBS (under president Clarence Peckham) has earned the reputation of creatively applying COTS techniques to military systems – without a “parochial” view of a government “MIL-SPEC mentality”. In short: the two companies’ approaches are complementary, though some of their product lines do overlap. That’s to be expected.

I anticipate GE to reach conclusions on Centers of Excellence, where engineering teams – or subsets of teams – are given the GE Fanuc Embedded “carte blanche” for certain technical aspects of what the whole group needs. Perhaps Radstone becomes the conduction cooled expert, with an emphasis on PowerPC SBCs, while SBS/VMIC become the Intel x86 architecture specialists. (Condor has already been anointed as the avionics and MIL-SPEC I/O Center of Excellence, based upon their history and success with ARINC and MIL-STD-1553 products and cores).

Radstone’s design facilities in the UK (Towcester, Bracknell, and Milton Keynes) plus in Ottawa, Canada and Chelmsford, MA will probably be consolidated. After all, there is undoubtedly overlap with other GE and GE Fanuc Embedded facilities.

Corporate PR and announcements will emanate from GE, proper. But I suspect GE Fanuc Embedded PR and marketing communications will come from the former SBS Albuquerque group, with European/ROW announcements coming from Radstone in the UK. This also raises the question of the North American sales team. I personally know the top dogs of the VMIC, SBS, and Radstone teams, having worked with some of them in a former life. They’re all top-notch, and have earned the respect of their customers and competitors alike. This will be a stickier situation, and one I don’t dare speculate about.

In the end, it’ll all work out. GE Fanuc Embedded is again acquiring some of the brightest minds in the VME (and COTS) industry, with a long reputation of innovation – and a healthy backlog of domestic and foreign military programs (or “programmes”, if you like). The challenge for GE Fanuc is to settle it out quickly for minimal disruption on the collective customer base. However, someone once said that General Electric does tens if not hundreds of acquisitions per year – I’m sure they know what they’re doing and how to do it efficiently.

C2

PS: And what of the competition? What’re Radstone’s key competitors saying, and is there a newcomer waiting in the wings to take Radstone’s place? On this latter question – keep an eye on three players: Mercury, Themis, and VMETRO. All of them are showing signs of becoming hard core, conduction-cooled, broad line military suppliers. All of them can “spell VME”. I’ll keep my eye on them, too.