Nevada City, California, March 10, 2011

New Venture Research (NVR) latest report on the ‘Merchant Embedded Computing Market – 2011 Edition’ analyzes the performance of the industry from 2002 – 2015. Although there are several hundred companies, most are fairly small in revenue and highly specialized, focusing on specific application segments with unique product requirements. The report tracks and analyzes five application markets, nine bus architectures and four form factors. Specific trends and issues of the forecast by application, bus architecture and form function are covered in detail in the report.

Whereas the overall MEC market is slowly recovering from the trauma of 2009′s economic meltdown, the performance of various market segments, bus architectures, and companies will recover at different rates. Total revenue was just under $5 billion in 2010, a 4 percent increase from 2009 revenue which had a 12-14 percent decrease over 2008. If the worldwide economies stablize, the MEC industry will likely recover at about 6 percent in 2011 to ~$5.2 billion.

The MEC report targets five specific application markets: Communications, Industrial, Medical, Military/Aerospace and an Other category that includes transportation, security, surveillance, point-of-sale/kiosk applications, etc. The Communication wireless segment is being driven by smart phone traffic. 3G/4G services are where the money is for carriers going forward and the wireline and optical networks are gearing up for upgrades to support the ever increasing traffic. The Industrial market particularly suffered from the financial crisis but investment in capital equipment infrastructure as well as test & measurement is starting to return.

The Medical segment was hit hard by the healthcare cutbacks which made purchasing MEC-based, large equipment much more difficult. The usually healthy Military/Aerospace segment is facing a rapidly declining defense department budget in the USA that is likely to cause a restructuring not seen since the end of the cold war.

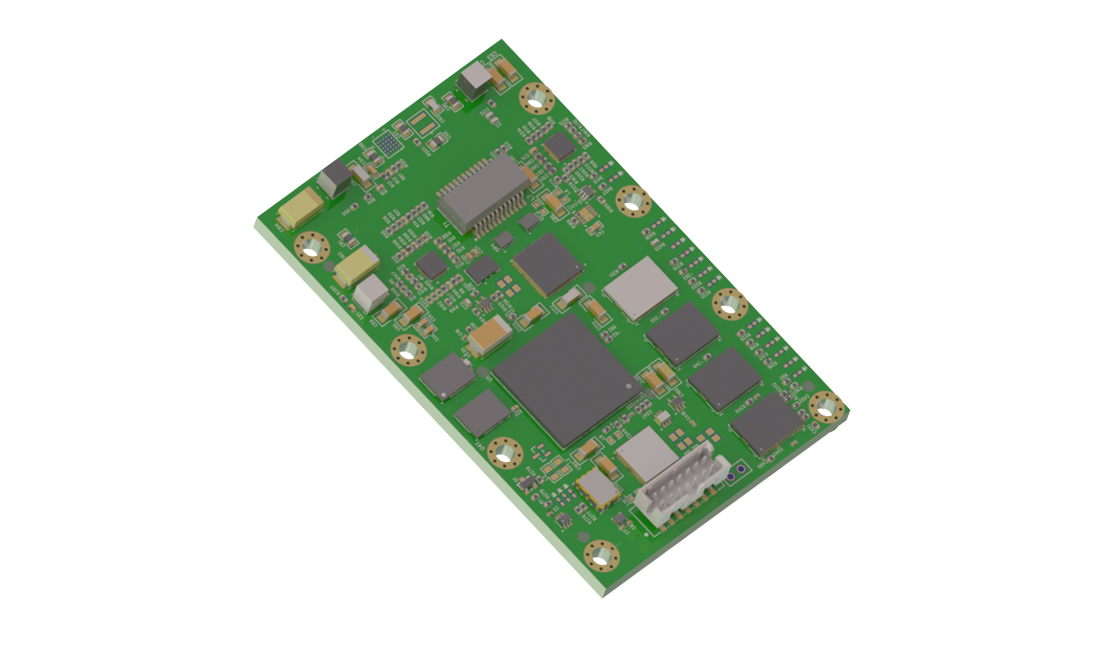

Each architecture has a different rate of adoption depending on the needs of individual application segments. Overall key trends are “Power is up and down; Green is the new color; and small is big.” New 40 and 32-nm silicon for microprocessors, graphics, DSPs and high integration I/O chips pack a lot of processing power while greatly reducing power consumption. High integration silicon and serial buses enable more small form factors (SFF) than in the past and are making many older, parallel bus structures, such as PCI, look like the bus architecture equivalent of a “clunker.” Bus structures continue to proliferate around the major and long established busses but the number of variances is past 100.

The MEC industry can be segmented into four form functions defined as: single-board computers (SBC), digital signal processor (DSP) boards, I/O boards and an ‘All Other’ category that incorporates a huge number of diverse and specific functions. In some applications I/O boards are proliferating and are customized to the wide spectrum of I/O functions that different applications use. In other applications, single-board computers are becoming the trend as they incorporate more and more functionality with advanced silicon and draw in DSP, graphics and many advanced I/O functions.

The ‘Merchant Embedded Computing Market – 2011 Edition,’ provides critical information on the electronics COGS and trends of this assembly market. For more information, see www.newventureresearch.com/wp-content/uploads/2[…]