Tokyo, October 4th, 2007 – Eurotech, a company engaged in the design, development and commercialization of miniaturized and high performance computers announced that it has entered into a contract to acquire 65% of the share capital of Advanet (headquartered in Okayama, Japan) and its subsidiaries Spirit 21, Vantech and Advanet R&D (collectively, the “Advanet Group”). This transaction is expected to close by October 31, 2007. Advanet is among the leading companies in the Japanese market in the design, development and production of embedded computers.

As of April 30, 2007, the Advanet Group’s sales totaled approximately 5.5 billion yen with EBITDA of approximately 1.1 billion yen, equal to 20% of total sales, and with Adjusted EBITDA amounting for approximately 1.5 billion yen, equal to 27% of total sales. Advanet counts clients among Japan’s most important manufacturers.

The consideration for the transaction has been set by the parties at approximately 7.6 billion yen and will be subject to adjustment based on the net financial position and current assets of the Advanet Group on the closing date. This consideration represents a valuation of the Advanet Group based on a multiple of 8 times the Adjusted EBITDA of the Group. The consideration for the acquisition will be paid at closing using the Company’s cash on hand, which is equal to 60 million Euro as of the date hereof.

The acquisition contract also contains a put and call mechanism for the remaining 35% of the Advanet share capital, which provides:

– the option for Eurotech (i) to acquire 25% of Advanet’s share capital in the 2 months following the approval of the Advanet Group’s financials for the period ending in December 2009, for consideration calculated by applying a multiple equal to 8 times the EBITDA of the Group as of December 31 2009, and (ii) to acquire the remaining 10% of Advanet’s share capital, during the period from the closing date until five years after such date, for consideration to be determined on the basis of a valuation agreed among the parties or prepared by an independent expert;

– the option for the Advanet shareholders (i) to sell Eurotech 25% of Advanet’s share capital in the 2 months following the approval of the Advanet Group’s financials for the period ending in December 2009, for consideration calculated by applying a multiple equal to 8 times the EBITDA of the Group as of 31 December 2009, and (ii) to sell the remaining 10% of Advanet’s share capital, after 5 years form the closing, for consideration to be determined on the basis of a valuation agreed among the parties or prepared by an independent expert;

“Advanet will allow Eurotech to enter the Japanese market as a major player and to further expand our presence in the Asian market, said Roberto Siagri, President and Chief Executive of Eurotech. “With this acquisition, Eurotech achieves the crucial size and international presence to position us by right among the world leaders in this sector. Advanet’s product portfolio and technologies are fully complimentary to our own and will allow us to further expand our product offerings, with inevitable benefits for all of the Group’s clients.”

Fumio Komatsu, Chief Executive of Advanet, said: “As managers we always pursued growth and success for the Advanet Group. I strongly believe that the global market represents a huge opportunity for Advanet products. To enter the Eurotech Group will allow us to move outside the Japanese market and to be ready to challenge a new larger market and start a new growth phase.”

Advanet

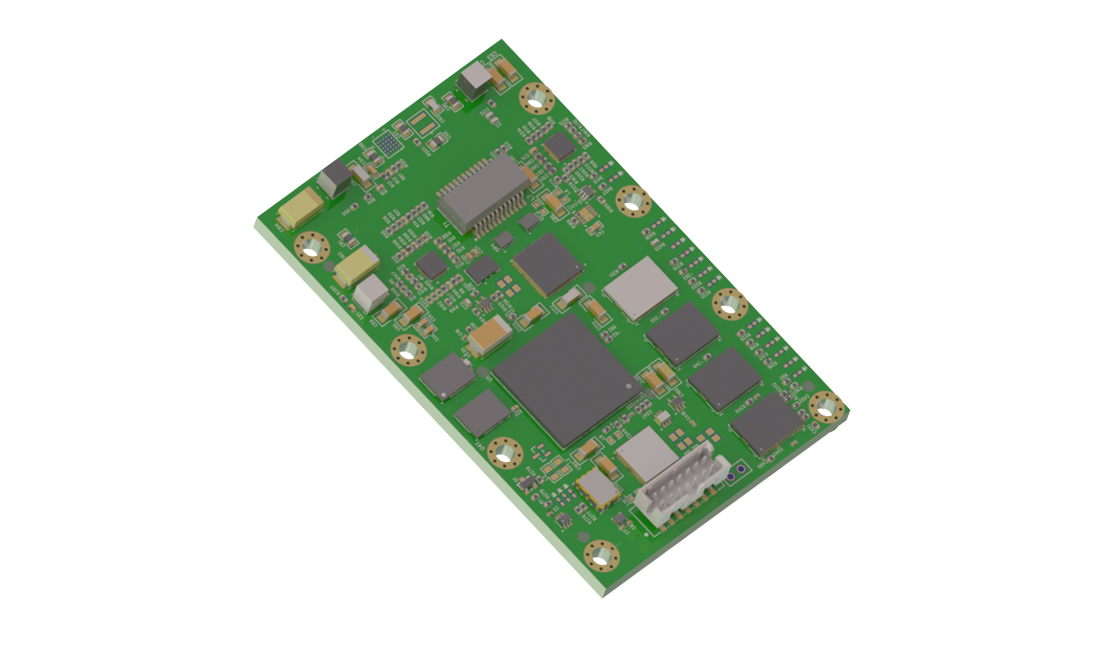

Advanet, Inc. is a leading manufacturer of single board computers, I/O, data acquisition, and communication products for the embedded markets. Advanet products include VME, CompactPCI, PCI & PMC boards for PowerPC and Intel Pentium architectures. Advanet has catered to the Automotive, Semiconductor, Medical, Telecom, Transportation, Power Generation, and Scientific industries for the past 26 years.

The Eurotech Group

Eurotech (ETH.MI) is a company active in the research, development, production and marketing of miniaturized computers (NanoPCs) and of computers featuring high-performance computing capability (HPCs).